Profit margin is the percentage of revenue left after all expenses are deducted. In its simplest form it is calculated thusly:

profit margin = (profit / revenue) * 100

Profit margin is a critical indicator of a company’s financial health, revealing the percentage of revenue that exceeds the costs associated with producing goods or services. By mastering this calculation, you can identify areas for improvement, implement effective financial strategies, and ultimately increase your profits.

We’ll delve into various methods for calculating profit margin, explore strategies for increasing profitability, and highlight the importance of operational efficiency.

Understanding Profit Margin

Definition and Importance

Profit margin is a financial metric that represents the percentage of revenue that remains as profit after all expenses are accounted for.

This post is written using accrual accounting terms. If your business uses cash accounting, substitute cash for revenue.

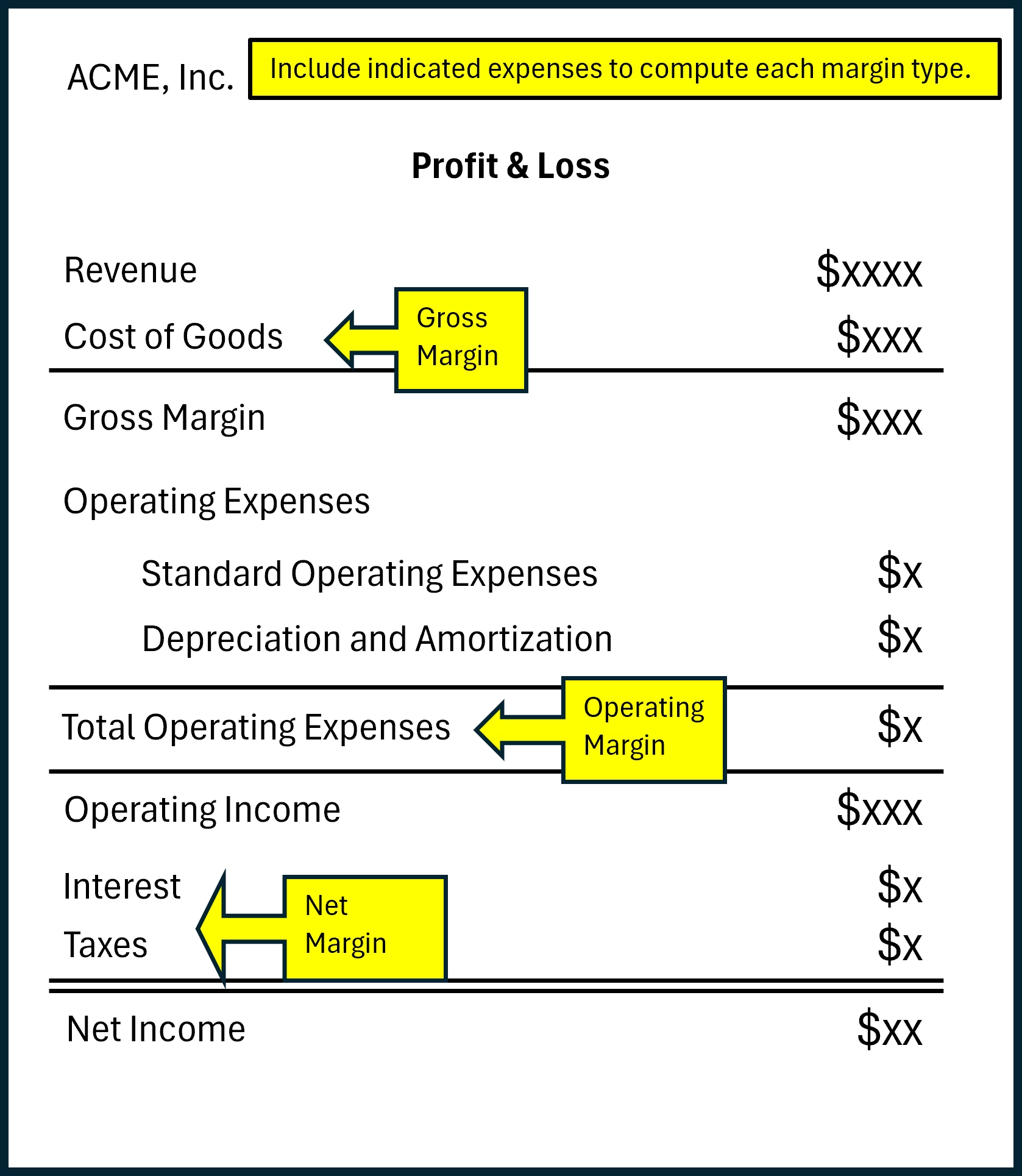

There are three primary types of profit margins: gross, operating, and net profit margin. Gross profit margin focuses on revenue remaining after deducting the cost of goods sold. Operating profit margin considers operating expenses, while net profit margin incorporates all expenses, including taxes and interest.

Profit margin metrics help gauge your company’s financial health and operational efficiency. A higher profit margin indicates better financial performance, suggesting that your company is effectively managing costs relative to its revenue.

Types of Profit Margins

Profit margins can be categorized into three main types: gross, operating, and net profit margins. Each type offers unique insights into a business’s financial operations.

- Gross Profit Margin: This measures the revenue left after subtracting the cost of goods sold (COGS). It can indicate how efficiently your company uses its resources to produce goods. A high gross margin may also be indicative of a strong pricing strategy.

- Operating Profit Margin: This considers both COGS and operating expenses, such as wages and rent. It reflects the efficiency of your core business operations before interest and taxes.

- Net Profit Margin: This is the bottom line, factoring in all expenses, including taxes and interest. It provides the most comprehensive picture of a company’s profitability. A strong net margin indicates overall financial health and effective management strategies.

Each margin type helps in assessing different aspects of increasing profitability and operational efficiency.

What about EBITDA?

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, attempts to evaluate a company’s financial performance and operational efficiency. It provides insights into a business’s profitability by focusing on earnings derived from core operations.

- Why EBITDA Matters: EBITDA strips out the effects of financial and accounting decisions, offering a clearer view of operational profitability. By excluding interest, taxes, depreciation, and amortization, EBITDA highlights the operational cash flow potential, allowing stakeholders to assess the business’s performance without the impact of financial structuring.

- Applications of EBITDA: Business owners and CFOs often use EBITDA as a key performance indicator (KPI) when comparing companies within the same industry. It is particularly useful in assessing firms with high depreciation or where interest expenses significantly skew net profit.

- The problem with EBITDA: Comparing companies using EBITDA can be difficult if they make different decisions regarding capital acquisitions. For example, one manufacturing firm leases its equipment – EBITDA is reduced since the lease expense is attributed to operating expenses. Another firm with a similar profile buys and depreciates the equipment – EBITDA is unaffected because depreciation is removed from the calculation.

You can think of EBITDA as Operating Profit with Depreciation and Amortization added back in. It is best used when comparing companies with similar capital allocation strategies or if you want to have a simple profitability metric for internal goal-setting.

Calculating Profit Margin

Basic Formula Explained

The formula for calculating profit margin is straightforward:

profit margin = (profit / revenue) * 100

This formula yields a percentage, representing the portion of revenue that remains as profit after all expenses are deducted.

- Profit: total revenue minus total expenses

- Revenue: total amount of income generated from sales of goods or services

- Expenses are determined by the type of margin you’re computing

Operating Margin includes both operating expenses and cost of goods; Net Margin is Operating Margin less interest and taxes. Put another way, Operating Income is Gross Margin minus Operating Expenses. Net Income is Operating Income minus Interest and Taxes.

By dividing the profit by the revenue, you determine how much of every dollar earned translates into profit. Multiplying by 100 converts this figure into a percentage, providing a clear metric for analysis.

Understanding this basic formula is crucial for evaluating a company’s financial performance. It reveals how effectively a company turns revenue into profit, guiding decisions on pricing, cost management, and strategic planning.

Example Calculations

Let’s explore some example calculations to better understand how to compute profit margins. Suppose a company generates $200,000 in revenue and incurs $150,000 in total expenses. The profit, in this case, is $50,000 ($200,000 – $150,000).

To calculate the profit margin, divide the profit by the revenue: $50,000 / $200,000 = 0.25. To express this as a percentage, multiply by 100, resulting in a 25% profit margin. This indicates that 25% of the revenue remains as profit after covering all expenses.

This example business keeps 25 cents for every dollar in sales.

Consider a second business in the same industry with $500,000 in revenue and $425,000 in expenses. The profit is $75,000. The profit margin is calculated as $75,000 / $500,000 = 0.15, or 15%.

This second business keeps 15 cents for every dollar in sales.

While this second business has more sales, and profit, than the first business, the profit margin is much lower which may indicate inefficient operations.

Increasing Profitability

Recall that profit is simply revenue minus expenses. Increasing profits can be accomplished by increasing revenue, lowering expenses, or a combination of both.

Increasing Revenue

There are two ways to increase revenue: sell more units and raise prices.

Pricing strategy is a complex topic and outside the scope of this post; however, many businesses have regular price increases to keep pace with inflation and prevent margin erosion. Take a look at your pricing and positioning in the marketplace and see if there is room to increase your prices.

Selling more units is not always as easy as simply wanting to sell more units. If you could sell as much as you wanted just by wanting to, you likely would have done so by now. A fair amount of planning and work is often required by offering more to sell, or expanding into new markets, or reaching currently unserved populations. Regardless, selling more, and consistently, is often not a quick fix.

Reducing Cost

This is where you can make an impact quickly. Consider profit expansion from a personal finance perspective: you have a job where you trade time and skill for money – this is your Revenue. Your mortgage, insurance, food, entertainment, and other expenditures are your Operating Expenses. In the short term it is difficult to make a big difference in your household profit by increasing revenue, but you have immediate control over your spend and can reduce some of it quickly if you desire.

Your business is the same. Some expenditures are fixed and require structural changes to reduce, like rent. Others, things in your business that are “nice to have”, may be reduced immediately and have an outsized impact on short-term profits. Additionally, cost-cutting measures are within your immediate control and require no additional effort in the market, like selling and price increases.

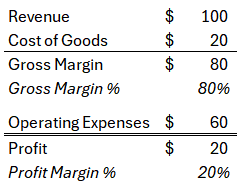

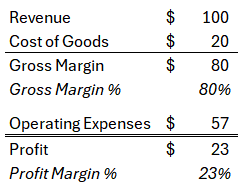

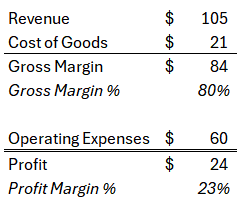

Consider this lemonade stand that has $20 in profit at a 20% margin.

This lemonade stand has fixed expenses, so modest increases in sales do not impact the cost structure. We want to improve the margins of this business, so we reduce our expenses by 5%, or $3, we improve the profit to $23, and the margin percent to 23%.

To achieve this same increase in profit margin percent without reducing expenses, we will have to sell 5% more lemonade.

Cutting $3 of Operating Expenses has the same effect on Profit Margin % as selling $5 more dollars of lemonade.

Common mechanisms for controlling costs

- Get efficient: if you have well-developed processes this might be the time to explore new systems.

- Budgeting: a budget is a numerical snapshot of your operating plan. The whole point of the budget is to exercise control over spend while implementing your plan.

- Clean house: when was the last time you reviewed your subscriptions? Software and other membership subscriptions will quietly mount up and erode your margins. Track these items separately and review – what can you consolidate or cut?

- Vendor management: revisit your spend by vendor and see where you might have some buying leverage. Can you negotiate better prices or payment terms?

- Avoid stockouts: stockouts reduce revenue, but I’m including it here since there is implied spend. Improve your demand planning and make sure your inventory levels are appropriate.

Perform Regular Financial Reviews

Conducting regular financial reviews is essential for ensuring your business remains on track to achieve its financial goals. These reviews involve analyzing financial statements, cash flow, and key performance indicators to assess your company’s current financial position and operational efficiency.

Regular reviews help identify variances between budgeted, forecasted, and actual performance, enabling you to pinpoint areas needing attention. For instance, unexpected increases in costs can be flagged early, allowing for timely corrective actions.

The act of regularly reviewing your financials, especially against a budget and forecast, can have surprising positive effects as you gain more insight into how you’re actually spending money and what you can do to reduce spend and improve your margins.